All Categories

Featured

State Ranch representatives sell whatever from home owners to automobile, life, and other prominent insurance coverage products. State Ranch uses global, survivorship, and joint global life insurance policies - universal life crediting rate.

State Ranch life insurance policy is usually conventional, providing stable alternatives for the typical American family. Nonetheless, if you're searching for the wealth-building possibilities of global life, State Ranch does not have competitive options. Read our State Ranch Life insurance policy evaluation. Nationwide Life Insurance Coverage markets all sorts of universal life insurance: global, variable universal, indexed global, and global survivorship plans.

Still, Nationwide life insurance strategies are very easily accessible to American family members. It aids interested parties get their foot in the door with a dependable life insurance strategy without the much extra challenging discussions about financial investments, economic indices, and so on.

Nationwide fills the crucial role of getting reluctant customers in the door. Even if the most awful takes place and you can't get a bigger plan, having the security of an Across the country life insurance policy can change a buyer's end-of-life experience. Review our Nationwide Life insurance policy testimonial. Insurance policy firms use medical examinations to evaluate your danger course when requesting life insurance policy.

Buyers have the option to alter prices each month based on life conditions. Naturally, MassMutual offers interesting and possibly fast-growing chances. Nonetheless, these plans often tend to do finest in the future when early deposits are higher. A MassMutual life insurance policy representative or financial expert can help purchasers make strategies with area for changes to fulfill temporary and long-term monetary objectives.

Adjustable Life Insurance Policies

Some buyers may be stunned that it supplies its life insurance policy policies to the general public. Still, military members take pleasure in one-of-a-kind advantages. Your USAA policy comes with a Life Event Choice cyclist.

If your plan doesn't have a no-lapse warranty, you may even shed coverage if your money value dips listed below a particular threshold. It may not be a terrific option for people who merely desire a death advantage.

There's a handful of metrics whereby you can evaluate an insurer. The J.D. Power customer complete satisfaction rating is an excellent alternative if you desire a concept of how consumers like their insurance coverage policy. AM Finest's economic strength score is another essential statistics to think about when selecting an universal life insurance coverage company.

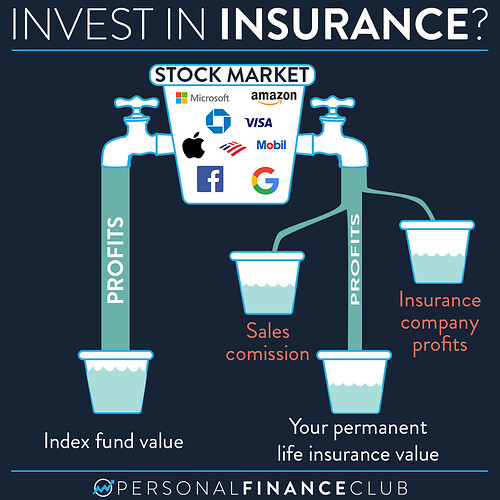

This is especially essential, as your cash value grows based upon the investment alternatives that an insurer provides. You must see what financial investment alternatives your insurance coverage service provider offers and compare it versus the goals you have for your plan. The ideal means to discover life insurance policy is to accumulate quotes from as many life insurance coverage firms as you can to understand what you'll pay with each plan.

Latest Posts

Books On Indexed Universal Life

Insurance Index Funds

Single Premium Indexed Universal Life